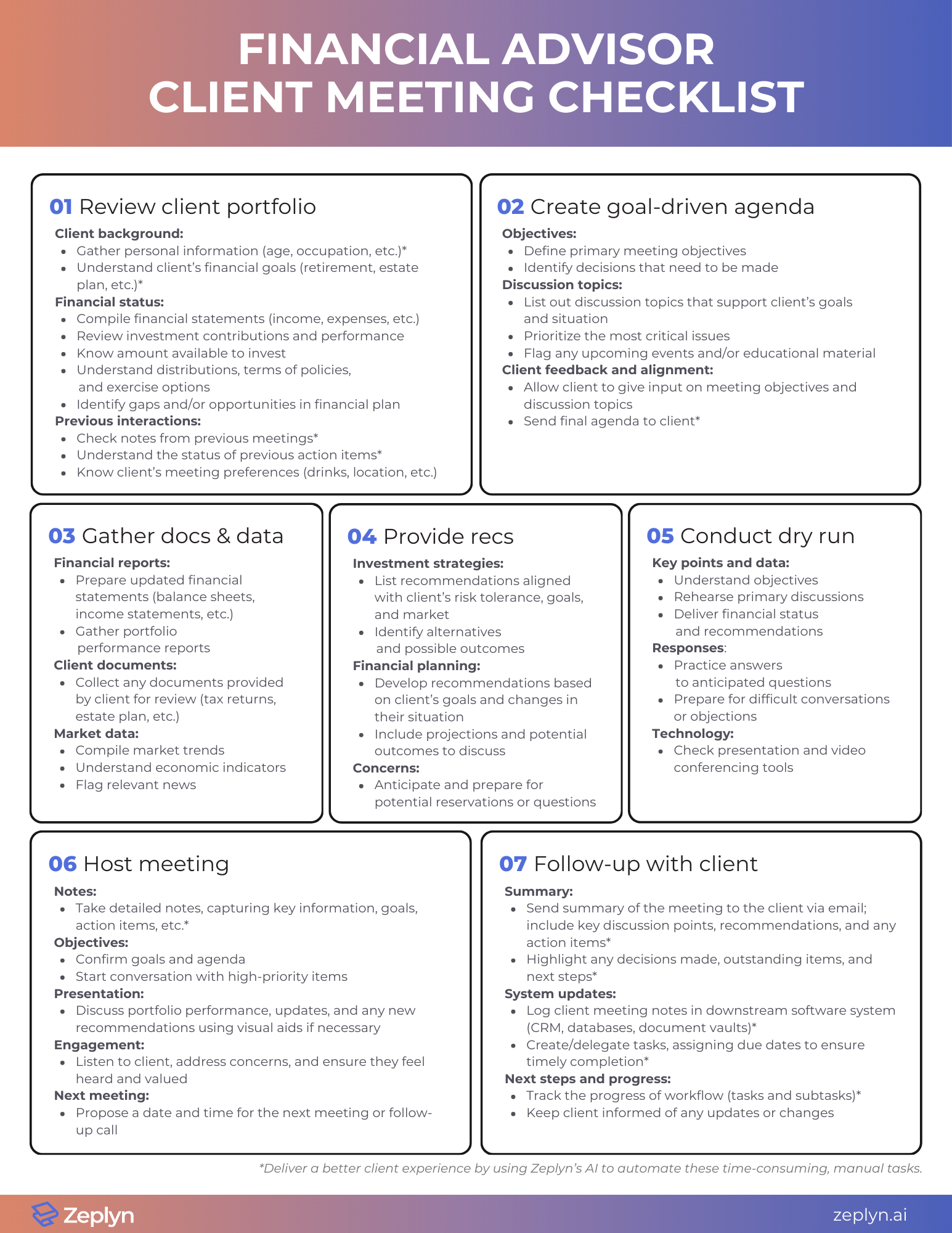

Every encounter you have with your client matters. Client meetings are no exception. In fact, they’re critical touchpoints that can significantly influence the level of trust and confidence a client has in your abilities. That’s why we built this: a detailed financial advisor client meeting checklist.

In this step-by-step guide, you’ll get exactly the details you’ll need to ensure a seamless experience.

TL;DR: A meaningful financial advisor client meeting checklist is extensive. Creating the type of meeting experiences that keep clients happy (and drive referrals) requires a lot of steps. AI, however, can streamline and automate the manual, time-consuming pieces, freeing you up to focus on the high-impact, high-reward activities.

Step 1: Review your client’s profile

Before any meeting, it is essential to have a sound understanding of your client’s specifics. So, reacquaint yourself with them. This includes reviewing their goals, financial history, investment portfolio, preferences, and any previous meeting notes. We recommend starting this process at least a week before your meeting.

a. Client background:

- Review client’s personal information (age, occupation, family situation).

- Know their financial goals (retirement, education funding, estate planning).

- Make note of whether or not the client’s accountant and/or attorney will be joining in the meeting.

b. Financial status:

- Analyze their current financial statements (income, expenses, assets, and liabilities).

- Review their investment portfolio and recent performance.

- Know what contributions the client is making and how much is available to invest.

- Verify required distributions, terms of policies, and options available to exercise.

- Identify any gaps and/or opportunities in their financial plans and insurance policies.

c. Previous interactions:

- Check notes from previous meetings to address any follow-up items or changes in their situation.

- Understand the status of all previous action items and be ready to speak to next steps.

- Skim over all previous communications and surface any details that may have been shared outside of formal meetings (ie. texts, LinkedIn messages, etc.).

- Look up client’s meeting preferences (ie. preferred drinks, location, etc.).

Step 2: Create a goal-driven agenda

Your client’s time is valuable. So is yours. That’s why the next step in the financial advisor client meeting checklist is building the agenda. A well-structured agenda keeps your meeting productive and focused, signaling to your clients that you value their time. It also shows your clients how well you plan and prepare for their success. And by anchoring the meeting agenda to very specific outcomes, you’ll be better able to keep all discussions on track and meet their expectations.

When setting your agenda, here are the core elements to consider.

a. Objectives:

- Define the primary objectives of the meeting (ie. review of portfolio, discuss new investment opportunities).

- Identify the decisions you/the client need to make during the meeting.

b. Discussion topics:

- List out topics to be covered based on the client’s needs, goals, and situation.

- Prioritize topics to ensure you get to the most critical issues first.

- Flag any upcoming events or educational opportunities that may support your clients in their financial goals.

Ahead of the meeting, be sure to send the proposed agenda to your client. Give them an opportunity to co-create the agenda with you by asking if there’s anything else they’d like to add. Then, once the agenda is locked in, share a final copy with your client.

Step 3: Gather relevant documents and data

Having the right documents and data at hand is crucial for a successful meeting. It fosters conversation flow and allows for informed decision-making. Here are several documents and reports you may want to have on hand. (This, of course, is not exhaustive and should be tailored to your client’s specific needs.)

a. Financial reports:

- Prepare updated financial statements, including balance sheets, income statements, and investment reports.

- Gather performance reports for current investments and portfolios.

b. Client documents:

- Collect any documents provided by the client for review (ie. tax returns, estate planning documents).

c. Market data:

- Compile recent market trends, economic indicators, and any relevant news that might impact the client’s investments or financial plan.

Step 4: Strategize and develop recommendations for client

After reviewing all of your client’s information, spend some time analyzing your client’s financial situation and preparing well-thought-out recommendations and solutions tailored to their specific goals. While this financial advisor client meeting checklist may feel overwhelming, note that you should spend the bulk of your meeting preparation here.

a. Investment strategies:

- Develop investment strategies that align with the client’s risk tolerance, goals, and market conditions.

- Prepare alternatives and scenarios to foster discussion on possible options.

b. Financial planning:

- Create or update financial plans based on the client’s goals and any changes in their personal or financial situation.

- Include projections and potential outcomes to support your recommendations.

c. Address concerns:

- Anticipate potential concerns or questions the client might have and prepare detailed responses.

Step 5: Conduct a dry run

We don’t think you necessarily need to rehearse a specific presentation. (Although, depending on what you’re sharing with your client, you may want to). We do think it’s important, however, to spend some time dotting your i’s and crossing yours t’s. This is an opportunity for you to ensure the accuracy of your material and a smooth flow, minimizing any points of friction beforehand.

a. Review key points and data:

- Go over the agenda and key discussion points to ensure you’re well-prepared.

- Practice delivering recommendations and explanations clearly and concisely.

- Review and confirm the accuracy of the financials you’ll review and the recommendations you plan to make.

**All of this is especially important when an Ops team member of Jr Advisor has compiled all the meeting prep details for you.**

b. Role-play scenarios:

- Consider role-playing different scenarios to prepare for various client reactions or questions.

- Practice handling difficult conversations or objections.

c. Check technology:

- Test any technology or presentation tools you plan to use, such as video conferencing software or presentation slides.

Step 6: Host and document the meeting

The way you structure your meeting will highly depend on the type of meeting you’re hosting. A first-time meeting will flow much differently than a quarterly review with a long-time client. That being said, every meeting should incorporate the following steps.

a. Take meaningfully notes:

- Be ready to take detailed notes, capturing key client information, goals, action items, etc.

b: Review objectives:

- Start the meeting by confirming the client’s goals and the agenda to ensure alignment.

- Kick-off the conversation with high-priority items.

c. Present information clearly:

- Discuss portfolio performance, updates, and any new recommendations using clear, understandable language and visual aids if necessary.

d. Engage actively:

- Listen to the client’s feedback and questions, address their concerns, and ensure they feel heard and valued.

e. Schedule next meeting:

- Propose a date and time for the next meeting or follow-up call to review progress and address any new issues.

Step 7: Follow up with a summary and action items

Effective follow-up is crucial for maintaining client relationships and ensuring that agreed-upon actions are implemented. It’s a great way to make sure important details don’t unintentionally fall through the cracks and an amazing way to build momentum and clearly document achievements you’re driving.

a. Summarize and share key points:

- Send a follow-up summary email of the meeting to the client, including key discussion points, recommendations, and any action items.

- Highlight any decisions made, outstanding items, and next steps.

b. Update your systems:

- Log client meeting notes in your downstream software system (CRM, databases, document vaults).

- Create (and potentially delegate) tasks, assigning due dates to ensure timely completion.

c. Execute next steps and monitor progress:

- Track the progress of workflow (tasks and subtasks).

- Keep the client informed of any updates or changes.

Put these guidelines to work. Download our financial advisor client meeting checklist.

Conclusion

It’s not lost on us that this financial advisor client meeting checklist is extensive and time-consuming. Preparing for client meetings is a critical aspect of a financial advisor’s role, involving careful planning, organization, and communication. By understanding the client’s profile, setting a clear agenda, gathering relevant documents, and developing tailored recommendations, advisors can ensure productive and effective meetings.

That being said, the process doesn’t have to be complicated or time consuming. With Zeplyn, financial advisors can streamline their workflows and automate the time-consuming admin tasks of meeting prep, note-taking, drafting follow-up emails, creating and assigning tasks, and updating their CRM.

Want to give it a try? Start your free trial.